Effective Ways to Calculate Retained Earnings for Your Business in 2025

Understanding how to find retained earnings is crucial for any business owner looking to track their company’s growth and profitability over time. This article will provide a comprehensive guide on retained earnings, covering its definition, importance, and methods to accurately calculate and report them. Whether you’re a small business owner or managing a large enterprise, mastering the concept of retained earnings can significantly enhance your financial reporting and decision-making processes.

Understanding Retained Earnings and Their Importance

**Retained earnings** represent the accumulated net income of a business that is retained rather than distributed to shareholders as dividends. In accounting, understanding **retained earnings** is vital as they form a significant part of a company’s equity on the balance sheet. Strengthening your grasp on **retained earnings** can greatly contribute to strategically analyzing a company’s growth potential, financial health, and capacity for reinvestment. As we delve deeper into how to use retained earnings, we will highlight their **importance for investors** and business strategy.

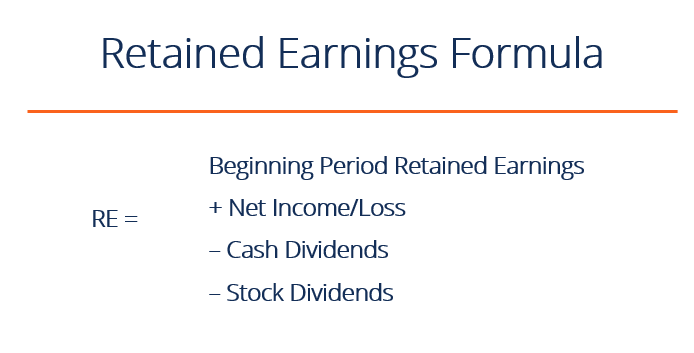

The Retained Earnings Formula

To effectively calculate retained earnings, it’s essential to learn the **retained earnings formula**: Retained Earnings = Beginning Retained Earnings + Net Income – Dividends Paid. This formula accounts for all profits that are reinvested back into the business instead of being distributed to shareholders. For instance, if a company’s beginning retained earnings amount to $50,000, and the net income for the current year is $20,000, while dividends paid out are $5,000, the calculation would be:

Retained Earnings = $50,000 + $20,000 – $5,000 = $65,000. As the formula highlights, **salary sacrifices, losses incurred, and additional distributions** can directly affect **retained earnings** over time.

Importance of Retained Earnings for Investors

Investors often consider **retained earnings** as a measure of a company’s long-term viability. A high level of **retained earnings** can indicate that a business has consistently earned a profit and chosen to reinvest it, potentially leading to growth and decreased reliance on external financing. Analyzing the growth pattern in **retained earnings** can also provide insights into a company’s strategy. For instance, businesses focused on aggressive expansion will typically show increasingly large retained earnings for investments in growth initiatives, which can be appealing to investors.

Calculating and Reporting Retained Earnings

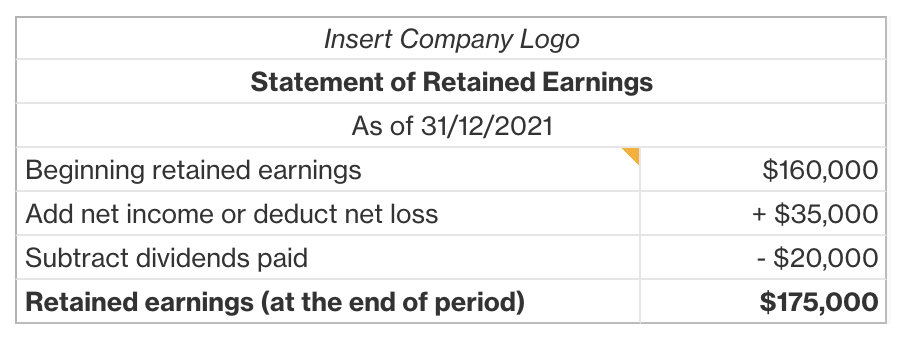

Once you’ve understood the fundamental aspects, the next step is mastering how to calculate and report **retained earnings** accurately on your financial statements. When creating a **retained earnings statement**, you’ll begin with the retained earnings from the previous period, adjust for income and deductions, and present the final amount.

Step-by-Step Guide to Calculating Retained Earnings

To ensure accurate calculations of retained earnings throughout your financial year, consider implementing the following steps:

- Identify the Period’s Beginning Retained Earnings: This is the amount carried over from your previous fiscal year.

- Add Net Income: Include the total net income generated during the current year from your income statement.

- Subtract Dividends: Account for any dividends paid to shareholders during the year. This amounts to cash outflows from the retained earnings pool.

- Prepare the Retained Earnings Statement: Present your retention balance as of the end date, detailing the components above clearly.

Retained Earnings on the Balance Sheet

On financial statements, **retained earnings** appear within the equity section of the **balance sheet**, alongside contributed capital. This placement underscores the role of retained earnings as internal funding, alongside external investments. Investors reviewing your financials closely analyze retained earnings since they reflect how much profit a company has not only kept but potentially reinvested for further business growth. A marked increase in **retained earnings** reflects positive business growth, while decreases often call for attention and potential strategic shifts.

Strategies for Managing and Improving Retained Earnings

Effectively managing **retained earnings** is paramount in preserving healthy financials. There are specific strategies a business can employ to improve its **retained earnings**, reinforcing its capacity for investment and operational growth.

How to Retain Earnings Strategically

Implementing a solid **retaining earnings strategy** includes prioritizing the reinvestment of profits into projects that will yield high returns. Aspects such as purchasing advanced technology or expanding facilities may further amplify income-producing capabilities. Implementing cost-lowering technologies and investing in training for employees can also remarkably increase operational efficiency, thereby boosting **net income**. When businesses make informed decisions on how to retain and reinvest, they can effectively build substantial capital, facilitating expansion and sustainability without significantly tapping into external financing options.

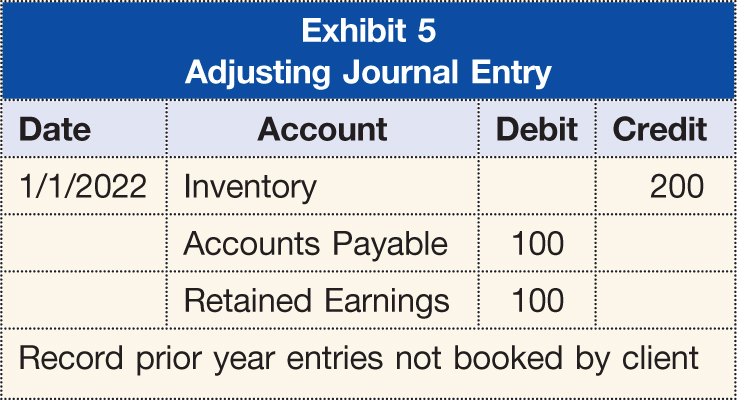

Adjusting Retained Earnings

Over time, businesses may find certain adjustments to **retained earnings** necessary due to accounting errors or changes in accounting policy. Any adjustments might affect how these earnings are viewed on the balance sheet. For instance, if earlier estimates of revenues were mistakenly high, this could mean reassessing prior calculations to ensure an accurate **retained earnings statement** going forward. Such adjustments emphasize transparency and accuracy in financial management, which in turn enhances investor trust and financial integrity.

Key Takeaways

- Retained earnings represent crucial accumulated net income, vital for business growth.

- Mastering the retained earnings formula and management aids informed decision-making.

- Improving retained earnings through strategic reinvestment can enhance company valuation.

FAQ

1. What is the retained earnings definition in simple terms?

In finance, **retained earnings** refer to the portion of net income that is retained within the company rather than being distributed to shareholders as dividends. This retained profit is available to reinvest in the business for expansion, paying off debt, or other operational needs.

2. How do retained earnings impact business decisions?

**Retained earnings greatly influence** business decisions by providing necessary capital for operations, growth initiatives, or acquisitions. A healthy level of retained earnings indicates sound financial health, which fosters confidence in both management and stakeholders to pursue new opportunities.

3. Can changes to retained earnings affect stock prices?

Yes, alterations in **retained earnings** can affect stock prices significantly. Investors often correlate high retained earnings with potential growth and reinvestment strategies, which can enhance the company’s stock value. Conversely, decreasing retained earnings could raise concerns among investors, possibly leading to drops in share prices.

4. What are the best practices for improving retained earnings?

Improving **retained earnings** can involve strategic planning, including careful allocation of profits, minimizing unnecessary dividend payouts, and investing in high-return projects. Consistently monitoring net income and adjusting strategies based on financial goals can lead to better retention of earnings over time.

5. What are common causes of retained earnings decreases?

**Decreases in retained earnings** can happen for several reasons such as significant dividend distributions, operational losses, or write-offs. Additionally, if a company experiences higher costs or lower revenues than expected, this can lead to a drop in the **retained earnings balance**.